4 Steps to become an Individual Investor

August 2, 2018

Did the stock market attract your interest? Do you want to save money and make sure it is invested correctly? Then it is time to learn the basics of investing into individual stocks.

Step 1: Things to consider

Before getting into the weeds you have to understand the risks and challenges before pulling the trigger on your investments.

First of all: How much are you willing to invest? Make sure that you invest regularly, but only money you know you will not need in the near future. Although the stock market presents good opportunities, you don’t ever want to sell just because you need the money. You can be sure this will not be the best time to sell.

As an individual investor you should also make sure you understand all the risks and typically only invest your own money once you have no remaining debt. Trying to trade on margins is a risky business.

Make sure to plan for the long term. Most gains for individual investors come from investing in good companies and keeping them for the long term!

Choosing the right broker

Step 2: Choose a broker that fits your needs

Which broker is right for you depends very much on your personal situation, existing back affiliations and location.

The most important thing to consider is to keep fees low. This involves trading of stocks as well as how much you pay monthly for the portfolio and for each individual stock. Also keep an eye on which stock exchanges the broker offers and how much they charge for each. If you trade foreign stocks you also have to consider currency conversion fees!

Some good brokers with small fees include:

Step 3: Finding great Public Companies and good investments

Now to the fun part! Deciding where you want to actually invest your money in. Make sure to take your time to look at past performances of companies, and that you understand their core business. Make sure to chose your investments on your opinion on the company, their strategy and how much you think they will succeed over the coming years. Do not try to just analyze the ticker charts to come up with your future productions.

Even when starting with a small investment. Make sure that you get a diversified portfolio. This might include up to five to ten stocks, depending how much money you are able to invest.

If you only buy a small position in a stock, make sure to keep an eye on the fees of your broker. You don’t want to have a good stock just to realize that all your market gains are eaten away by the fees.

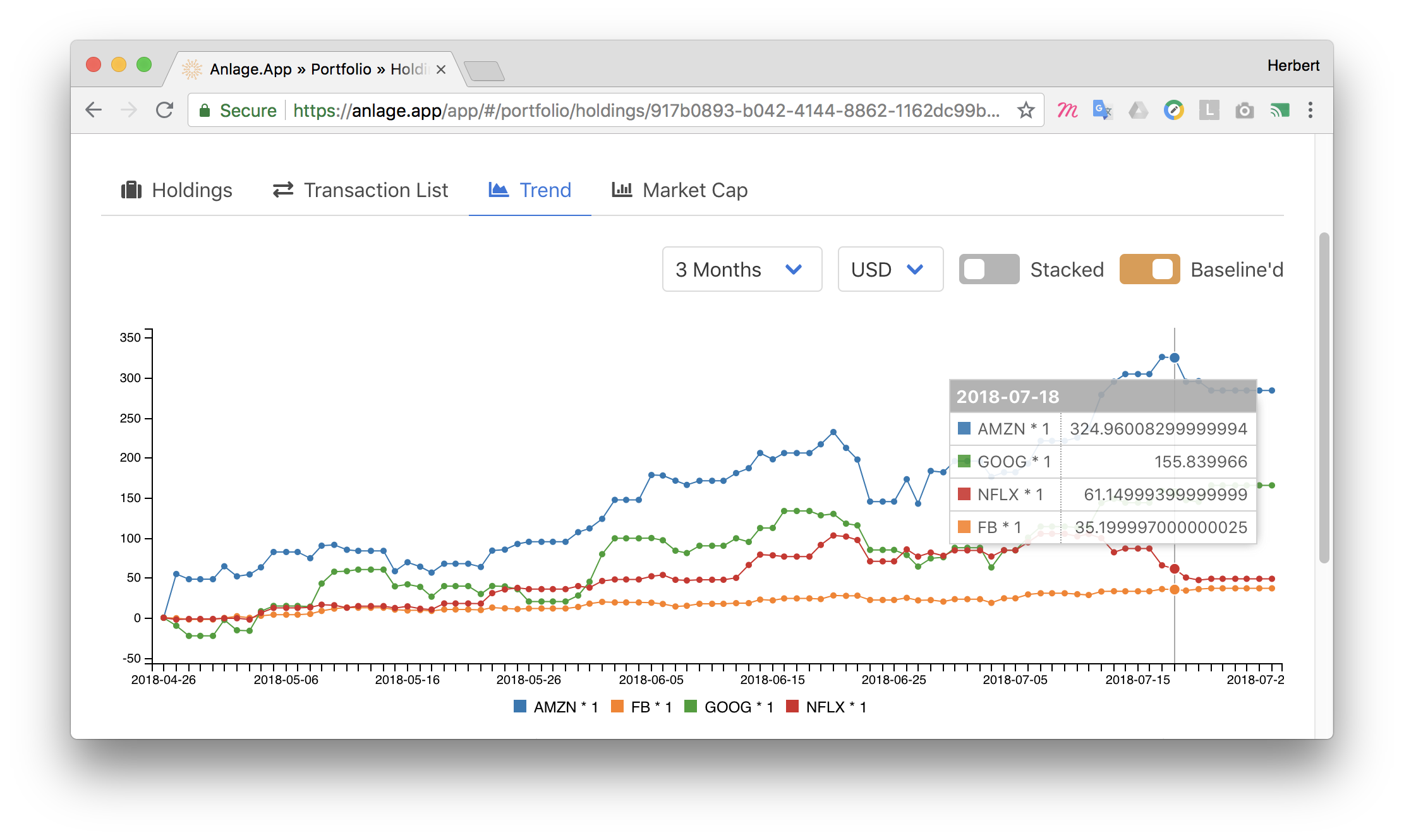

Observe and analyse your portfolio with Anlage.App

Step 4: Hold, Observe and Learn

As long as nothing fundamentally changes in the companies you have invested in, you should usually hold them as long as possible. You have chosen winning companies, after all.

To keep track of your investments make sure to add your positions to Anlage.App to easily know where your portfolio is trending and if your investment strategy is working.