Diversify your Portfolio: Four simple ways to find great Investment Opportunities

September 4, 2018

When investing in individual stocks it is important to always be on the lookout for good investment opportunities. Always keep an eye open for companies and interesting developments. In this article we look at a few ways to increase the number of stock ideas to discover.

The more ideas you have, the better the chances are to uncover great opportunities. But remember this is just a first step, much like brainstorming. Once you have a few interesting stocks you have to further get into the details and analysis.

Keep a list of your stock ideas in a watchlist.

1. Keep a watchlist

First, make sure that once you find a great stock investment opportunity you have a facility in place to keep an eye on those stocks so you can come back to them later. It is also helpful to keep track of their performances over time before actually buying into them.

You can easily create a secondary portfolio inside Anlage.App to keep your ideas. This way you get the same analytics and reports as for your actual real money portfolio.

So create your watchlist, and as you come across interesting companies, just add the stock as soon as possible. Once it is time to actually invest more money, you can go back to your watch list to come up with your best winning stocks.

2. Look Around You

Sometimes it is just worth looking around and thinking about what you are using daily without even thinking about. Maybe a product or service you love is produced by a publicly traded company? Maybe it is even in a niche which is not yet mainstream and you have an advantage in the market. Like maybe it’s your hobby or profession, which has the potential to grow exponentially.

For example - Are you a big hobby photographer, maybe you are using quite a bit of Photoshop or Lightroom. So maybe Adobe (Ticker: ADBE) has more to offer than the general public realises? Or are you a project manager using Jira or similar tools by Atlassian (Ticker: TEAM). Or are you big into running or cycling and have been using “Smartwatches” from Garmin (Ticker: GRMN) long before Apple & co even “invented” them? Taking a second look into those categories is always a good idea. Just make sure that your insights are really an advantage rather than a distraction from bad earning reports.

Follow the news.

3. Follow the News

Even though it is certainly a bad to react to every news, it is worth keeping an eye on companies who might be regularly in the news. Whether positively nor negatively It is just a good opportunity to get to know companies better and add them to your watchlist.

4. Weekly Biggest Movers & 52 week lows/highs

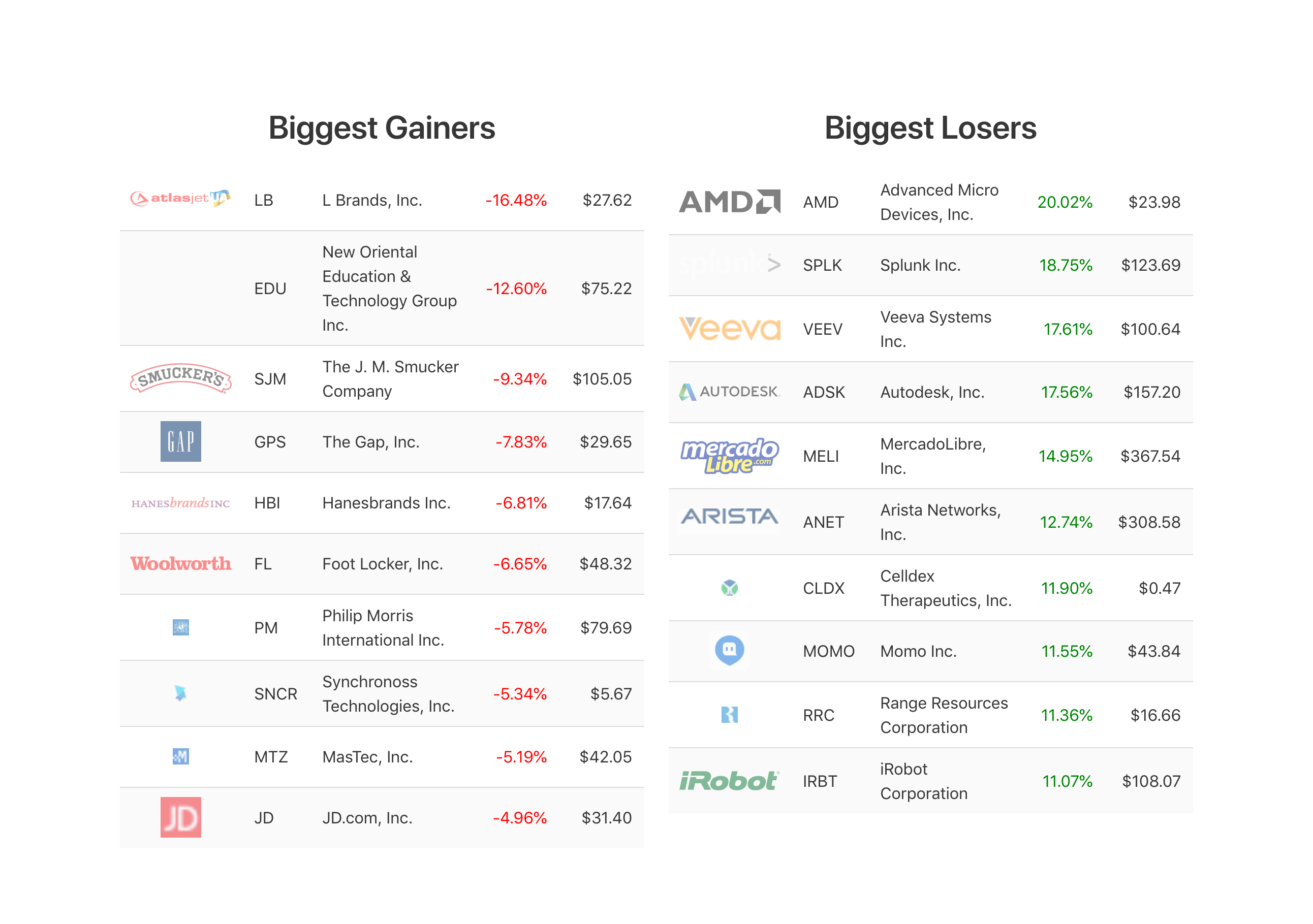

A good way to discover great investment opportunities is to focus on the biggest movers of the week, or stocks reaching their 52 week high or low. Check out our Weekly reports

Weekly reports from Anlage.App

-

Biggest weekly movers: These are stocks which had the most gains or losses during a week. This can have several reasons. Maybe the company released their quarterly earnings and the stock market (over)reacted - either positively or negatively. Or maybe their CEO started a tweet storm on twitter (not looking at Tesla).

-

52 week lows: These are companies which reached their lowest market capitalization in over a year. This might mean that this was just a temporary problem or scandal (for example VW’s Diesel Skandal) without too much change to the fundamentals of the business. So maybe it would be a good investment opportunity?

On the other hand it is als possible that it is a long term trend that the company loses in value, and you should probably stay away from it.

-

52 week highs: Companies reaching their highest stock price for the year. If you look at great companies, those which are the winners in your portfolio will tend to always go higher (hopefully). So maybe it is also a good timing to join the winning stock. It is important to make sure that it’s not overvalued. But if you find a company which every week reaches a new 52 week high, maybe it is time to take a closer look!

Make sure to subscribe to our Weekly reports for your weekly dose of the biggest movers of the week as well as companies reaching their 52 week low or high.

So what is on your watchlist?

What are your current ideas for stocks? Do you have more ways to come up with good investing opportunities? Let us know in the comments below!