What is a cheap stock price?

August 14, 2018

Everybody wants to time their investments to get in on a good deal and not overpay. But in the stock market, what affects the share price? And how can we assess if it would be a good investment right now?

Share Price

First, we have to establish what a share price actually is.

So let’s look at a very basic definition according to Wikipedia:

A share price is the price of a single share of a number of saleable stocks of a company, derivative or other financial asset. In layman’s terms, the stock price is the highest amount someone is willing to pay for the stock, or the lowest amount that it can be bought for.

Okay, that’s easy to understand, isn’t it? Sarcasm aside, basically the absolute value of a share does not tell you anything at all. Take, for example, General Electric (GE) compared to PayPal (PYPL). GE has a current (August 2018) share price of 12.45 USD compared to PYPL at 89.01 USD. So which company is priced better?

Some basic Market Cap Calculations

Market Capitalization

You obviously can’t tell from that number, and nobody can tell you whether it is a good evaluation/price or if it is overvalued. For this, some basic maths is required. Multiply the share price by the shares outstanding to arrive at the company’s market cap.

In our nice examples:

- GE $12.45 USD (per share) * 8.691 (billion shares outstanding) = ~$108.2B USD market cap

- PYPL $87.01 USD (per share) * 1.183 (billion shares outstanding) = ~$102.9B USD market cap

What is this supposed to tell us? Well, even though both companies have a vastly different share price, their market share is pretty much the same (right now). This way you might get a first feeling about the evaluation by comparing those two companies and how you feel about their future.

This is obviously only one factor to get a first impression about the scale of the evaluation.

Comparing Market Caps

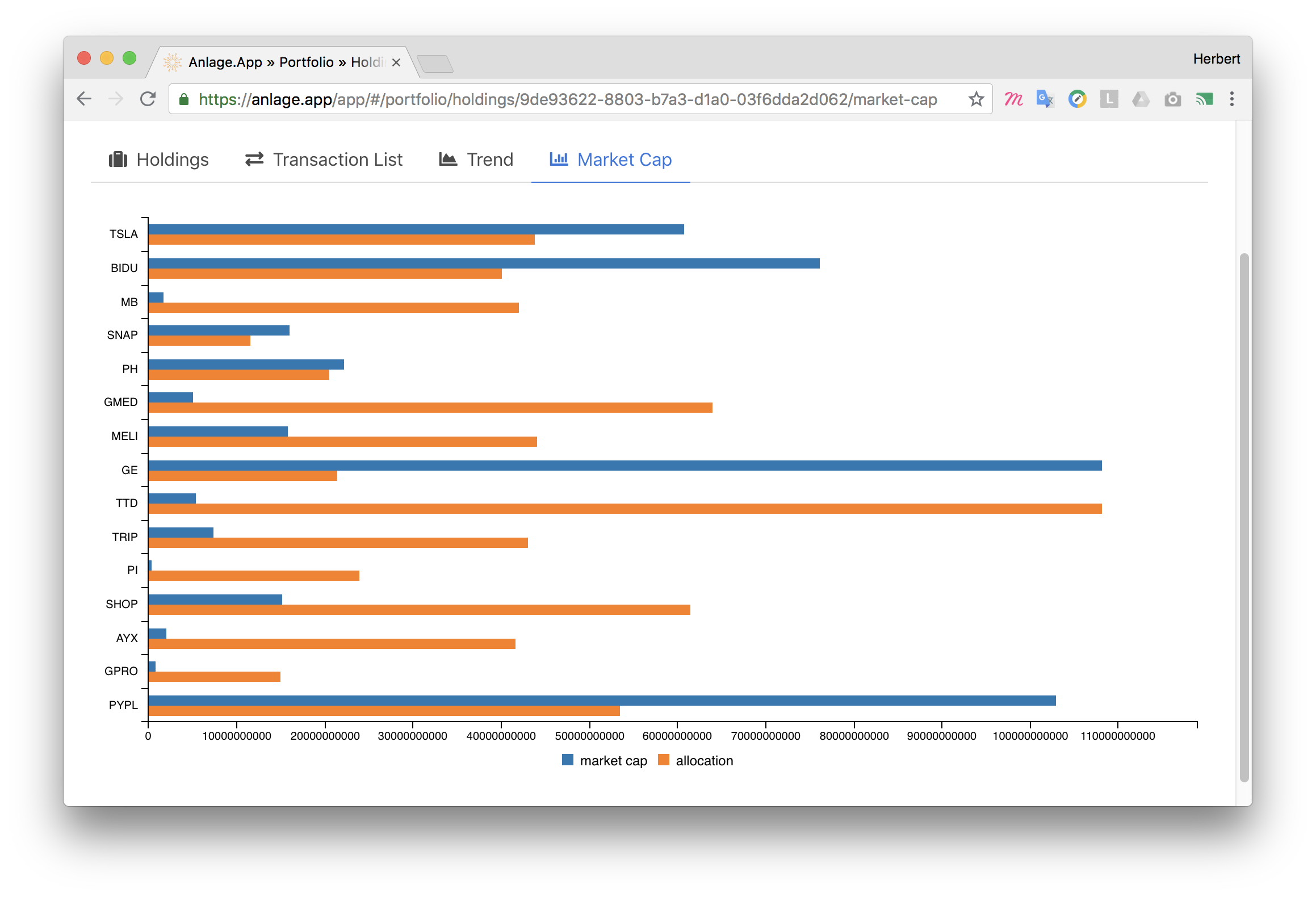

One very interesting experiment is also to compare the market caps of companies in your portfolio to each other. Since you are already familiar with those companies you might have a better feeling when comparing them with each other.

Compare market caps

In addition, it’s valuable to compare the absolute market caps to how much of your portfolio those stocks are allocating. The theory being, that smaller companies are typically more volatile.

To do this, just import your portfolio into Anlage.App and open your “Market Cap” graph.